marin county property tax exemptions

Please contact the districts directly at the phone numbers located under your name and address on the front of your property tax bill for exemption eligibility requirements or visit. If you enter your parcel number the website pulls up a list of all the exemptions for which you are eligible that show up on your tax bill.

Applying For A Property Tax Exemption

To qualify for a senior low-income exemption you must be 65 years or older by December 31 of the tax year own and occupy your residence located in the Special Tax Zone No.

. Some states specify exemptions such as a sale resulting from a divorce or death a transfer from parent to child gifts and transfers between partners. If you claim an exemption you must submit written documentation proving the exemption at the time of recording. If you have questions about the following information please contact the Property Tax Division at 415 473-6168.

Individuals who may qualify include those who are seniors disabled low-to-moderate income or have special circumstances eg medical conditions that require extra water. Exemptions are available in Marin County which may lower the propertys tax bill. Time is short to submit applications for exemptions and discounts on an array of Marin add-on property taxes and agency fees.

To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria. If you have questions about the following information please contact the Property Tax Division at 415 473-6168. 13 rows The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

Additionally parcels which are classified by County Assessor Use Codes 15 and 53 90 are also exempt from this tax. Measure C Zones and Boundary. 2 of the Marin County Free Library District for Measure L or the town of Corte Madera for Measure K and earn a total annual household income of not more than 80 of the median.

If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption. By applying for the Homeowners exemption you can save approximately 70 on your property taxes each year. To receive the full homeowners exemption the property owner must reside on the property January 1 and file the homeowners exemption claim form with the Marin County Assessors.

There is also a full list of such exemptions countywide. If the service member dies while performing the qualified service the person occupying the deceased service members home may file for the exemption. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of.

Owner must be 65 years old or older by July 1 of any applicable tax year Property must be an owner-occupied single-family residence house condo townhome An exemption application must be filed annually before June. There is also a full list of such exemptions countywide. The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70.

Marin County is responsible for assessing the tax value of your property and that is where you will register your appeal. These are deducted from the assessed value to give the propertys taxable value. Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you.

Marin County collects on average 063 of a propertys assessed fair market value as property tax. This would result in a savings of approximately 70 per year on your property tax bill. For the 2019-20 tax year the assessed value would be reduced by 90756 thereby reducing tax liability.

13 rows The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. The amount exempted increases 3 each year. These exemptions include churches non-profits and local governments that meet the standards for exemption from ad valorem tax ie the basic property tax.

Exemptions are available in Marin County which may lower the propertys tax bill. Marin County tax office and their website have the rules procedures and submission documents that you need. Admin April 20 2021 COST News.

Any unit of real property in the District that receives a separate tax bill for ad valorem property taxes from the County Tax Collector. All homeowners in Marin County may be eligible for a 7000 exemption on the assessed value of their primary home. If you enter your parcel number the website pulls up a list of all the exemptions for which you are eligible that show up on your tax bill.

Prior to starting make certain you comprehend the requirements for filling out the forms and preparing your appeal. With respect to matters specific to the levy of the special tax including any exemptions. These are deducted from the assessed value to give the propertys taxable value.

Calculating The Transfer Tax in Marin County. County of Marin June 7 2022 Statewide Direct Primary Election Measure E. Exemptions and Taxable Value.

Individuals who may qualify include those who are seniors disabled low-to-moderate income or have special circumstances eg medical conditions that require extra water. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Exemptions to Transfer Tax in Marin County.

Time is short to submit applications for exemptions and discounts on an array of Marin add-on property taxes and agency fees. Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you.

Marin Residents Have Until Monday To Pay Property Taxes

Understanding California S Property Taxes

Property Tax Re Assessment Bubbleinfo Com

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing

Sc Johnson S Administration Building Research Tower Exempt From Property Taxes Frank Lloyd Wright Homes Frank Lloyd Wright Architecture Building

Understanding California S Property Taxes

Property Tax Exemption For Live Aboards

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5FHWRWLNJRAPVLHXCMLUYRY5IM.JPG)

How To Slug It Out With Your Governing Bodies Over Property Taxes

Do You Have To Pay Taxes If You Live On A Boat Yacht Management South Florida

Understanding California S Property Taxes

Property Tax California H R Block

What Is A Homestead Exemption California Property Taxes

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing

For Seniors Keeping Your Property Taxes Low

Property Tax Re Assessment Bubbleinfo Com

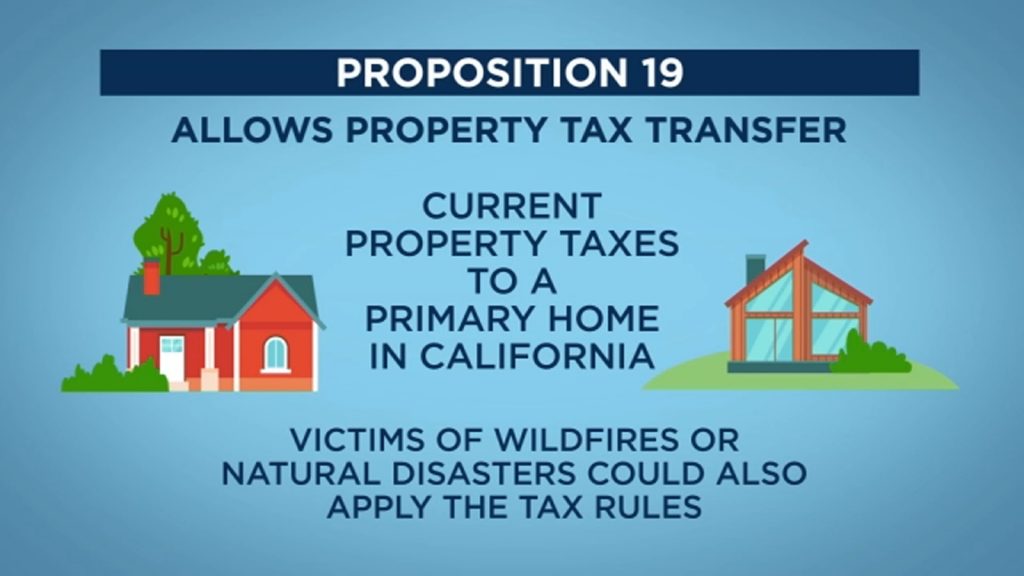

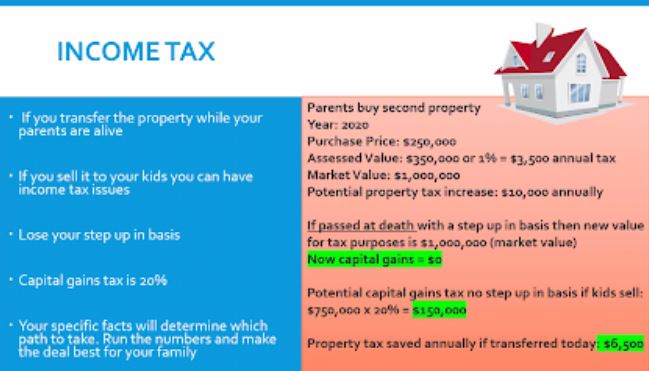

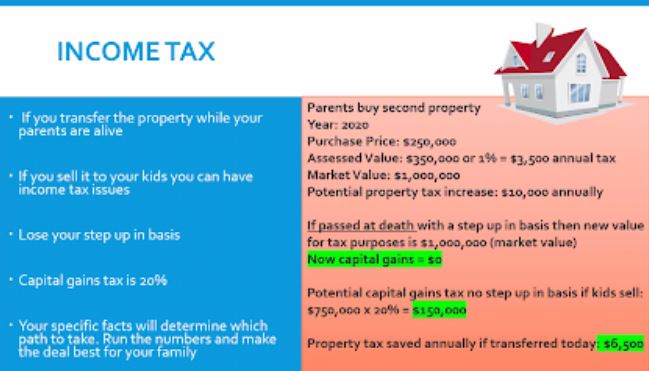

How To Inherit Your Parents House And Their Low Tax Bill Too